Electronic Trading Technologies: How They’ll Make A Difference in Your Business

Macro Market Trends

Technological advances have transformed financial markets to be more efficient and faster than before. The phenomenon of startups emerging in the financial market has been a catalyst for the competition in the capital markets ecosystem itself, driving startups and incumbents to be the best in the market. The industry can continue to see improving better tools invented along the way; technologies that are increasingly better in providing more data insights and cheaper access that is available to all.

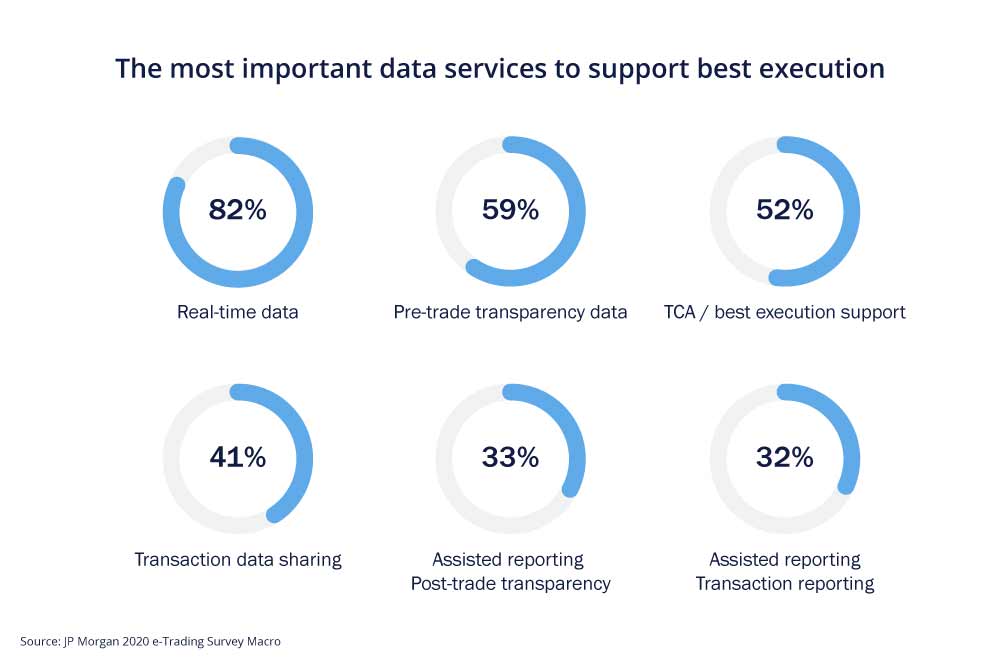

However, many players in the industry are still struggling to adapt and maneuver new technologies in their daily operations to overcome digital disruption. The survey conducted by JP Morgan highlights the most common issues that are still faced today by many traders around the world, including workflow efficiency, data availability and best execution requirements.

The application of new technologies such as automation and best execution helps traders to perform better and proficiently in achieving their trading goals. According to the survey, financial institutions and traders in 2020 are looking for solutions that can provide real-time data, data distribution and assisted reporting capabilities. The only way for trade markets to remain relevant today is to utilise tools that can streamline trade operations, improve workflow efficiency, provide data availability across channels and achieve best execution requirements.

Workflow efficiency

As the trading industry streamlines various layers in the trade workflow, the market has seen the benefit of automation efficiency, i.e. many technology providers today have successfully automated dealing procedures which previously required 10-20 dealers on the desk, to only 2-3 dealers to manage trades. From front to middle and back office, automation has shifted the manually intensive transaction-based operation into a cost-effective electronic system. These advancements do not only transform the efficiency in the trade lifecycle, but also increase execution speed; fast is the new norm.

Data availability

With faster execution expected from trade markets, data has been a focal point in the processes; any information from pre-trade to post-trade data sets are now accessible in real-time and can be distributed across various channels. Real-time data access allows buyers and sellers to receive the best price for trade execution, enabling profit maximisation on both ends while reducing processing costs. Furthermore, modern applications such as machine learning can transform large data sets into analytical information, assisting traders with higher accuracy and precision for data-driven decision making.

Compliance

Many trading platforms now are equipped with features such as assisted reporting setups, enabling firms to monitor flow electronically and efficiently comply with regulatory reporting requirements. With workflow integration and automation, electronification allows better data management for audit trails processes across the trade lifecycle.

Hydra X

To improve the overall efficiency of trading firms, Hydra X offers tech stack with capabilities such as:

- Matching Engine: A low-latency matching system that enables high throughput trade allocation, with interoperable modules including: alert parameter calibration, real-time supervision, order book replay and visualisation.

- Request-for-Quote System: Electronic trading module for automated discovery and execution of off-exchange transactions in a wide variety of assets.

- Pricing Engine: Pricing module enables users to gain complete control over all aspects of price generation to flexibly price products tailored to each customer. Quoted prices can be disseminated in real time across various channels, in streaming or over front end GUIs.

- Risk Engine: An independent, ultra low-latency solution with risk control operations carried out in-memory.

Looking Ahead

With the market’s current state rapidly shifting towards automated trading, real-time data, analytics and electronic audit reporting, the industry will strive to beat every year going forwards. Emerging technologies will perpetually change the trading scene; financial institutions and traders have to be agile and quickly adapt to changes that disrupt the market. Last but not least, market professionals are expecting a higher adoption rate of artificial intelligence in the coming 3-5 years.

UP NEXT